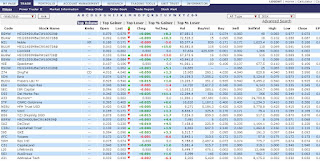

The market today sudden had some vibrant activity with stocks running in the background. Overall it looks mix but there were some popping of hidden buying which to the naked eye, it's hard to determine but for the trained eye, everything seemed so obvious. Carefully watching for blue chips now for the right timing before going for a long.

Ronald K - Market Psychologist - A Stock Market Opportunist

:.

:.