Brexit. The only word to describe market activities for this month. The volatile day to day movements presented opportunities for traders and investors alike. Whether its Brexit correction, post-Brexit rally etc, markets had been irrational at times. As long term investors, we should instead focus on the fundamentals of the companies that we are investing in, rather than being affected by short term market noises. Surprisingly, despite a volatile month, STI ended higher than last month at 2840 points.

For this month, I have attended the following AGMs/EGMs/briefings - Natural Cool, General Magnetics, Cheung Woh, Transit-Mixed Concrete, Noble Group, Ascendas India Trust and Imperium Crown.

For my top 30 holdings, Best World continues its good run on news that its direct selling license in China had been secured. Isetan returned to the list after announcing that it will be selling its property at 112 Killiney Road. CapitaLand is also back into list after I accumulated the stock this month on share price weakness.

I have bought the following companies from the market this month - Bukit Sembawang Estates, BBR, CapitaLand, Chuan Hup, Hong Fok, iFAST, Kencana, Keppel Corp, Koh Brothers, LTC Corp, Mandarin Oriental, Overseas Education, Pan Hong, S i2i, Sing Holdings, SembCorp Industries, S'pore Shipping, UOL, Wing Tai and Yeo Hiap Seng. No sell trade was done.

I have participated in the following scrip dividend schemes this month - Aspial, AusNet Services, China Everbright, DBS, Maxi-Cash, OCBC, Raffles Medical, Tuan Sing, UIC, United Overseas Australia, UOB Kay Hian and UOL.

I have also accepted the following voluntary delisting/cash offers this month - CM Pacific, NOL and Select Group. My stake in Lantrovision was also being acquired via scheme of arrangement.

Next month will be another AGM season as most companies having financial year ending 31 March 2016 will be holding their AGMs. As usual, I will be attending some of these AGMs to get updates on the performance of these companies. I will also be conserving some cash to participate in Noble Group rights issue.

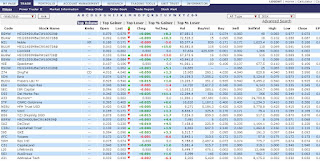

My S'pore Stock Portfolio - Top Holdings, cash investment only (correct as at 30 June 2016)

Top 30 Holdings (Sing$ Denominated shares)1. United Engineers

2. Metro Holdings

3. Jardine C&C

4. Bonvests

5. Haw Par

6. Sarine Technologies

7. Hong Fok

8. Hotel Grand Central

9. A-REIT

10. The Hour Glass

11. SGX

12. Hotel Royal

13. Bukit Sembawang Estates

14. Best World

15. Singapura Finance

16. Keppel T&T

17. GK Goh

18. Old Chang Kee

19. UOL

20. Hong Leong Finance

21. ComfortDelgro

22. Hiap Hoe

23. Far East Orchard

24. CapitaMall Trust

25. Hotel Properties

26. Sing Investment & Finance

27. Isetan

28. Spindex

29. CapitaLand

30. Stamford Land

Top 5 Holdings (US$ Denominated shares)

1. Jardine Strategic

2. Hong Kong Land

3. Mandarin Oriental

4. Jardine Matheson

5. Dairy Farm

Top Holdings (HK$ Denominated shares)

1. Fortune REIT

2. Shangri-La Asia

Top Holdings (Aust$ Denominated shares)1. AV Jennings

Top 5 Holdings (CPF OA investment) 1. Keppel Corp

2. Streettracks STI ETF

3. CapitaMall Trust

4. A-REIT

5. Challenger Technologies

My Hong Kong Stock Portfolio1. Peace Mark Holdings - Under Voluntary Liquidation

My Australia Stock Portfolio1. GPS Alliance Holdings Limited

My Unlisted Company Portfolio1. Automated Touchstone Machines Ltd

2. Iconic Global Limited

3.

Dongshan Group Ltd (formerly known as Greatronic Limited)

4. General Magnetics

5. Fastech Synergy

6. Beauty China- Under Liquidation

7. Memory Devices

8. Jurong Tech - In liquidation - Compulsory winding up (Insolvency)

9. FM Holdings

10. Zhonghui - In liquidation - Compulsory winding up (Insolvency)

11. FerroChina - Under Liquidation

12. FirstLink Investments

13. NEL Group

14. Jets Technics

15. Guangzhao Industrial Forest - In liquidation - Compulsory winding up (Insolvency)

16. Hongwei Technologies Limited (In Provisional Liquidation)

17. FDS Networks Group

18. Aussino Group - In liquidation - Creditors' voluntary winding up

19. China Oilfield Technology

20. China Milk Products Group

My Unit Trust Portfolio:http://www.fundsupermart.com/main/community/Portfolio_View.svdo?id=P199 :.

:.